|

External newsletter June 2025 - N° 170

|

|

|

|

|

|

|

EDITO

Protecting innovation

|

|

|

|

|

Dear Business Angels friends, dear readers,

Spring brings its share of changes and renewal. In anticipation of our Annual General Meeting scheduled for Monday June 16th at 5pm at the Mairie du 7e arrondissement in Paris (dear members, mark your calendars and come one, come all), I'm delighted to announce the arrival of Corentin Gaudelot as BADGE's new Managing Director. As a young graduate entrepreneur, Corentin has already built up a wealth of experience in a short space of time, which will be useful to the development of our network. See the detailed announcement below. As one swallow doesn't make a spring, I'm also pleased to welcome Ilona Chouin until the summer vacations.

Olivier Blandin, an insurance expert specializing in the problems faced by entrepreneurs and start-ups, gives us a reminder of the importance of having the right cover for your business. It is estimated that 7 out of 10 businesses will have been victims of at least one fraud attempt in 2019 (according to a 2020 Euler Hermes study). The risks are manifold, and the damage can be considerable: loss of turnover, destruction of data, damage to reputation and, of course, loss of time. It's not always possible to avoid a cyber attack, but everyone has a responsibility to protect themselves by anticipating the risks. At BADGE, we have chosen to store our members' personal data and the confidential information of Project Developers on the DEALFLUX platform, which is based on a 100% French, secure cloud offering.

This morning, Bruno Bonnell commented on the radio on one of the objectives of France 2030, for which he is responsible, saying that he was aware that "of the 54 billion euros that France finances in space, quantum, bioproduction and new agriculture, between 10 and 12% will be lost. We have just published our annual report for 2024: the 10-year loss rate of the sums invested by our members is 7.6%. This is an excellent result, pending profitable exits, of which we counted two last year with multipliers greater than 2. You can find the full report online on our website in the news section, describing our activity and giving all the figures and performances of the network.

It's time to join Les Business Angels des Grandes Ecoles and contribute to private support for innovation.

Best regards,

Paul Leondaridis,

Chairman of Business Angels des Grandes Écoles.

|

|

|

|

|

|

INTERVIEW

Antonio Nunzio D'Angelo,

CEO & Founder MEDICUD

|

|

|

|

|

|

1) Could you tell us a little about MEDICUD and your background?

Medicud is a start-up born out of a discussion I had with a surgeon, during which an unmet clinical need was identified. The clinicians were looking for an economically viable device capable of reducing the occurrence of post-operative complications, particularly wound infections. Being a materials science engineer with a background in watchmaking, I immediately thought of building on existing negative pressure therapy devices by replacing the electronic suction system with a completely mechanical one. A simple but winning idea to reduce costs while maintaining the highest clinical efficacy.

2) Can you explain how your device works and what its main benefits are for patients and healthcare professionals?

Dryum uses the principle of negative pressure therapy, i.e. continuous suction for a week of all the liquid produced by the wound, which is mainly pus, and which, as you can imagine, would cause infection if it stagnated in the wound.

The aim was to combine:

- efficacy, TPN is the most effective treatment today in reducing infections, from 10% of the dressing to just 3%!

- cost/content, Dryum costs half the price of competitors on the market today

- ease of use. Dryum is applied like a normal dressing at the end of the procedure, and is activated by a simple press of the finger. Pus is drawn up and stored in the reservoir to keep it away from the wound.

Dryum thus optimizes the wound healing process, reducing healing time, costs for hospitals and workload for clinicians. As the device is ultra-portable and requires no special maintenance, patients can be quickly discharged and continue treatment at home. What's more, being completely silent and unobtrusive, it does not affect patients' daily lives.

3) Why did you choose to work with business angels, and in particular the BADGE network?

We clearly identified France and the USA as our reference markets. Because of the size of our fund-raising, and because we were looking not only for financing but also for the creation of a network of professionals who could help us broaden our expertise, business angels were the natural choice. Of the various networks, BADGE was clearly the one that offered the best business angels, with a high level of post-graduate training in a wide variety of sectors, from finance to management to engineering. We are confident that the members of BADGE will be able to provide us with the right advice when we are called upon to make the most important strategic decisions.

4) What are your next challenges? Where do you see MEDICUD in five years' time?

Over the next two years, Medicud will move from the pre-market stage to commercialization. This will be accompanied by two major challenges: obtaining the regulatory approvals needed to market a medical device in Europe and the US, and validating Dryum's performance and safety via a clinical study on human patients will be a major step in the near future. All this will be accompanied by the development of the commercial side of the team, which will above all require a sales manager to drive market entry. Over the next three years, Medicud's Dryum device should become a benchmark for surgical incisions in the European and American markets. This will be achieved through clinical studies providing a medical/economic evaluation demonstrating Dryum's superiority over its competitors, and through aggressive marketing via medical device distributors.

5) What advice would you give to other start-ups looking to raise funds?

The first piece of advice I'd give is this: tenacity is the essential quality of an entrepreneur. You must never give up: if your project is solid, investors will recognize it.

It's also crucial to target the right investors, whether business angels or funds, to contact. If they are unfamiliar with the sector and don't understand the issues at stake, it's very easy to get nothing but rejections, often with little justification.

Furthermore, it is strongly recommended, wherever possible, to solicit introductions via entrepreneurs already financed by the targeted investor, or by a member of his network, notably in a business angels group.

Finally, the most important aspect remains your ability to explain, clearly and concisely, why your start-up is an opportunity not to be missed - and why you are the ideal team to take it forward.

|

|

|

|

|

French Tech unveils the Next40/120 Class of 2025

|

|

|

|

|

The French Tech Next40/120 Class of 2025 has just been unveiled, confirming the growing strength of French tech. Selected for their rapid growth, financial strength and capacity for innovation, the 120 companies represent the best of France's entrepreneurial fabric. They will have sales of 10 billion euros by 2024, with average growth of 27%, and 93% of them are already active internationally. A third of the winners generate annual revenues of over 100 million euros, and almost half of non-DepthTech companies are now profitable. Artificial intelligence plays a central role in this year's graduating class: 35% of start-ups integrate it into their core offering, and almost all use it internally. DeepTech is also making strong headway, with almost a quarter of the winners positioned in strategic sectors such as quantum, cybersecurity, healthcare or the ecological transition.

|

| Read more |

|

|

|

|

|

|

Key Man Insurance: a strategic tool for Business Angels

|

|

|

|

|

In the world of innovation capital, the solidity of a start-up often rests on one or two key people. In the event of an accident, death or disability, the entire balance of the company may be called into question, with a direct impact on investors. Key person insurance is one of the protection solutions available to anticipate this risk. It provides the company with a capital sum designed to compensate for the loss of a resource essential to its development, while preserving business continuity.

Recent simulations show clear orders of magnitude: for a sum insured of between €500,000 and €3,000,000, premiums vary widely depending on the age of the insured person. These data provide a useful basis for assessing the benefits of including this coverage in your financing strategy.

For Business Angels, Key Man insurance is a real security lever: it protects the valuation, reassures co-investors and reinforces the resilience of the project financed. Simulation results are available on request.

|

|

|

|

|

|

|

|

News from our funded startups

|

|

|

|

|

|

|

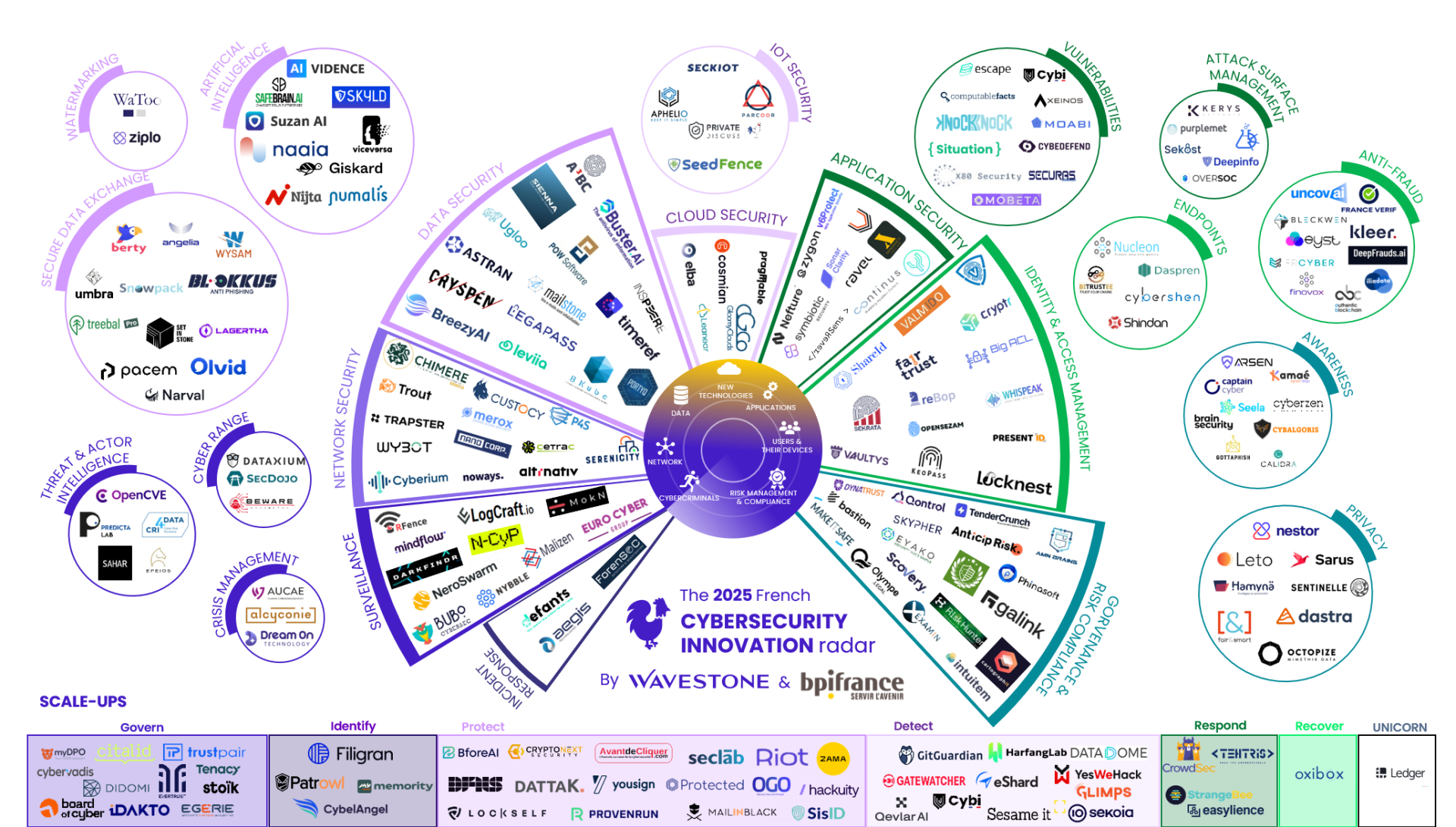

Inspeere and Haryon join the Wavestone 2025 radar

start-ups that count in cybersecurity

|

|

|

|

|

Every year, consulting firm Wavestone publishes its Radar of French cybersecurity start-ups, a mapping of the French ecosystem featuring the most innovative players in 10 key areas: identity management, sovereignty, cloud, resilience, confidentiality, incident response, etc.

Inspeere and Haryon (ex-Knock Knock) make their entry in the 2025 edition, which lists 150 start-ups selected for the relevance of their positioning, their capacity for innovation and their development momentum. A well-deserved accolade for these two young start-ups, who offer disruptive solutions to critical issues.

|

| Read more |

|

|

|

|

|

|

VivaTech: the 2025 edition in review

|

|

|

|

|

BADGE-funded start-ups were well represented at VivaTech 2025, the must-attend European tech event held in Paris from June 11 to 14. With over 165,000 visitors, 13,500 start-ups and a strong international presence, this edition confirmed the dynamism of the ecosystem, particularly around AI, DeepTech and transition issues. For the start-ups supported by our network, it was an opportunity to present their solutions, meet partners and gain visibility with investors and major corporations. A great showcase for these ambitious projects.

|

| To find out more |

|

|

|

|

|

|

|

Our startups are recruiting

|

|

|

|

|

|

|

Kinvent offers connected devices for physical rehabilitation. The company is looking for several profiles to join its team (Export sales representative, Head of acquisition & CRM, Customer care assistant).

|

| I am applying |

|

|

|

|

|

|

|

|

Great projects to invest in within our network

|

|

|

|

|

|

|

|

Kimialys develops and markets an innovative chemical treatment for surfaces used in diagnostics (nanoparticles, chips, electrodes), making it possible to increase the sensitivity and specificity of tests, and thus pave the way for new clinical applications. Kimialys' core technology is based on a proprietary method of pre-functionalizing biochips and nanoparticles, and represents a major breakthrough in biosensor coating.

|

|

|

|

|

|

|

|

|

Symbiose is an innovative platform leveraging AI to revolutionize forest management through advanced remote sensing and fundamental models. By integrating various sources of Earth observation data, such as hyperspectral imagery, LiDAR and radar, Symbiose provides accurate, real-time analyses of forest condition, climate risk and asset valuation. Thanks to the use of large language models (LLMs), the platform integrates a virtual forest expert capable of formulating personalized, actionable recommendations. It enables forest owners to optimize their resources, anticipate risks and promote sustainable management in the face of climatic challenges.

|

|

|

|

|

|

|

|

BioHive, a biotech based at the Genopole in Évry-Courcouronnes, is developing stem cell-derived human skin organoids, reproducing all skin structures, including hair follicles, in healthy and pathological versions. Collaborating with Sanofi on atopic dermatitis and leading cosmetics companies, BioHive innovates for high-potential markets such as alopecia, redefining the standards of dermatological research.

|

|

|

|

|

|

|

|

Skydrone Robotics is developing the first modular drone capable of intervening on live lines, reducing intervention costs by a factor of ten and facilitating the deployment of smart grids. With renewable energies gaining ground, this technology makes operations safer by limiting human risks, optimizing costs and intervention times, and helping to accelerate the energy transition. Winner of the France 2030 program, Skydrone Robotics has been awarded a €1.8 million grant, and is backed by key partnerships with SICAME and SAFRAN.

|

|

|

|

|

|

|

|

Founded in 2020, deeptech start-up MOÏZ designs and manufactures autonomous sensors. These sensors draw the energy they need from their environment, and send measured data (temperature, gas flow, hygrometry, etc.) using a low-power communication protocol. MOÏZ sensors operate without batteries or wires! Easy to install, they require no maintenance and can be installed in a wide range of environments with a heat source of around ten degrees (hot pipes, mechanical parts, etc.).

|

|

|

|

|

|

|

|

Posithôt has developed non-radioactive positron generators, the result of fundamental research carried out at CEA Saclay. These generators produce a positron flux 50 to 200 times greater than that of traditional radioactive sources, with a version under development aiming for a flux 1000 times greater. This technology can detect a wide range of internal defects, from the atomic scale down to several microns, without altering samples. It has applications in many industrial and scientific fields: metals (early detection of damage), polymers (study of free volume), ceramics (characterization of defects in coatings), semiconductors (analysis of dopants), thin films, porous or amorphous materials.

|

|

|

|

|

|

|

|

|

As part of the France Angels x Blockpulsepartnership, a series of webinars is offered to member networks to better meet the needs of the startups they support. Discover the next webinar in a long series:

Expert's voice: "How do you achieve a round of financing via an SPV (Single Purpose Vehicle) in 2025?"

- Thursday, July 10

- 11am to 12pm

Master the structure of an SPV and simplify the management of a large number of investors in your next round of financing.

With the participation of :

|

|

|

|

|

Philippe Rase

Co-Chairman of France Angels

|

|

|

|

|

Thibaut Ingelaere

Founder of Blockpulse

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you have any questions, please do not hesitate to contact Sylvain Godard, Managing Director.

of France Angels and Philippe Rase Co-President of France Angels

|

|

|

|

|

|

|

|

|

|

|

|